Governor of the Central Bank of Nigeria ( CBN), Mr Godwin Emefiele, yesterday, allayed fears over speculated distress syndrome in Nigeria’s banking industry following seven banks failures to scale its recent stress tests.

Emefiele who made the clarification at a briefing to roundoff the 2019 annual meetings of the International Monetary Fund and the World Bank in Washington DC, said the Nigerian banking industry still stands on a sound footing hence the widespread speculations about insolvency should be ignored by the banking community.

The governor said “First, I will reiterate that the strategic health of the Nigerian banking industry remains very strong. The Central Bank has as a matter of policy in 2015 tried to avoid being sensational about stress testing which has become part of our daily, normal routine in trying to check the strategic health of the Nigerian banking industry. So what you will find is that from time to time, maybe one bank fails one ratio, we advised that the bank should improve on that ratio, whether it is capital adequacy, liquidity or other forms of prudential ratio that we will prescribed to the banking industry. So the fact that you have read that seven banks failed stress test does not mean that those banks are weak."

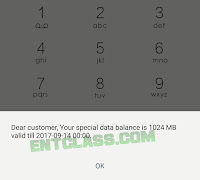

Meanwhile, the Central Bank of Nigeria ( CBN ) has ordered commercial banks to immediately reject telecommunications companies whose USSD transactions come at inflated costs. CBN Governor Godwin Emefiele, who gave the advice in Washington DC, said he had already told bank chief executives to move their businesses and traffic to telecom companies that are ready to provide USSD services at the lowest possible, if not zero cost, in line with the bank’s objective to raise the nation’s financial inclusion target to about 80 per cent by 2020.

He said the controversial issue of USSD came up at a meeting with the telcos a few months ago where he appealed to them to lower their charges. He however regretted that some of the mobile operators are still charging high rates which prompted the latest directive to banks.

Copy the link below and Share with your Friends:

About Blogindoor

About Blogindoor

No comments:

Post a Comment